how to check irs unemployment tax refund

Visit IRSgov and log in to your. Use the information from the form but do not attach a copy of the 1099-G to your federal income tax return because TWC has already reported the 1099-G information to the IRS.

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa

You can use the IRS online tracker applications the Wheres My Refund and Amended Return Status tools.

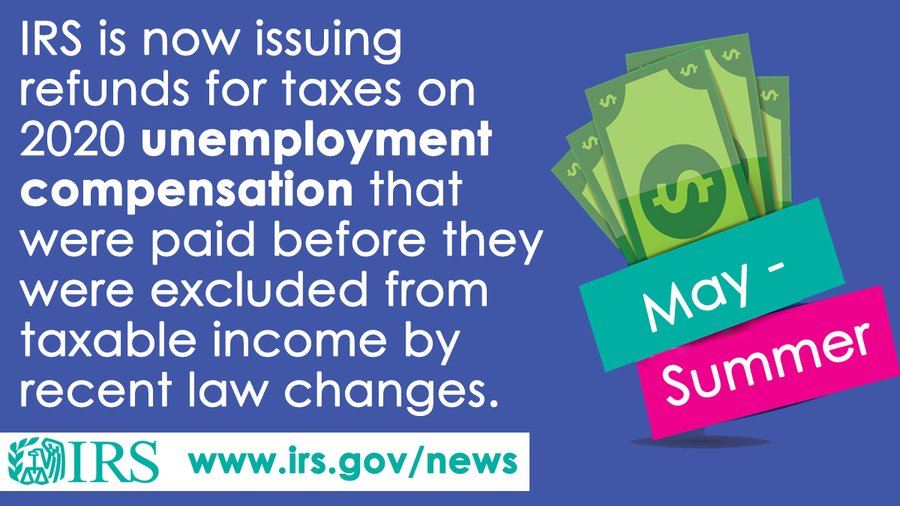

. TAX SEASON 2021. IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. The IRS online tracker applications aka the Wheres My Refund tool and the Amended Return Status tool will not likely provide information on the status of your unemployment tax refund.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their 2020 tax returns. Check e-file status refund tracker. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. Wait times to speak with a. The 1099-G form provides information you need to report your benefits.

Heres how to check online. Go to the EPFO portal. Click on the Submit button to check the status of your PF claim.

Viewing your tax records online is a quick way to determine if the IRS processed your refund. Still they may not provide information on the status of your unemployment tax refund. The first refunds are expected to be issued in May and will continue into the summer.

Another way is to check your tax transcript if you have an online account with the IRS. Sadly you cant track the cash in the way you can track other tax refunds. Click on Know Your Claim Status.

You may be prompted to change your address online. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt. Tax calculators.

You can also call the IRS to check on the status of your refund. Each January we mail an IRS Form 1099-G to individuals we paid unemployment benefits during the prior calendar year. The only way to see if the IRS processed your refund online is by viewing your tax transcript.

The employer too shall contribute with the same amount. If you were expecting a federal tax refund and did not receive it check the IRS Wheres My Refund page. All tax tips and videos.

Tax Tools and Tips. Enter your UAN and enter the captcha image. Youll need to enter your Social Security number filing status and the exact whole dollar amount of your refund.

Said it would begin processing the simpler returns first or those eligible for up to 10200 in excluded benefits and then would turn to returns for joint filers and others with more complex returns. For this round the average refund is 1686 direct deposit refunds started going out Wednesday and paper checks today. IRS unemployment refund update.

Enter the following details. How to track and check its state The tax authority is in the process of sending out tax rebates to over 10 million Americans who incorrectly paid.

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Break Refund How To Check Your Irs Transcript For Clues

6 691 Irs Refund Photos Free Royalty Free Stock Photos From Dreamstime

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment

Irs Issues 430 000 More Unemployment Adjusted Income Tax Refunds Cpa Practice Advisor

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

You Have One Last Chance To Get A Surprise Tax Refund This Year The Irs Says

Waiting For Your Unemployment Tax Refund About 436 000 Returns Are Stuck In The Irs System

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

About 7 Million People Likely To Receive Tax Refund On Unemployment Benefits

14 4 Billion Worth Of Tax Refunds Finally Given To Eligible Taxpayers Irs To Distribute 1 600 Refunds Each Before The Year Ends The Republic Monitor

How To Find Your Irs Tax Refund Status H R Block Newsroom

Interesting Update On The Unemployment Refund R Irs

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

So There S No Fourth Stimulus Check But You Can Still Get A Child Tax Credit Wkrc

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time